News

State PSC approves Georgia Power rate rollback

ATLANTA – State energy regulators authorized Georgia Power Wednesday to reduce customer rates by $122 million to reflect ... Read more

ATLANTA – State energy regulators authorized Georgia Power Wednesday to reduce customer rates by $122 million to reflect ... Read more

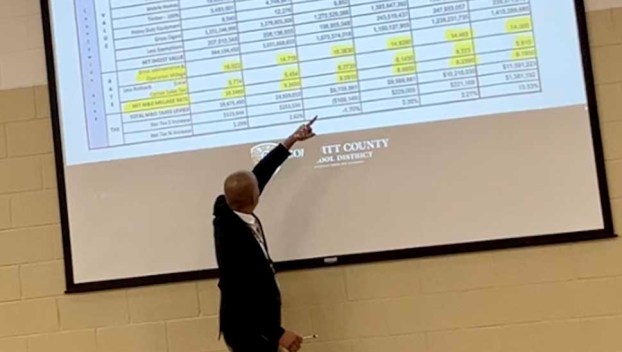

MOULTRIE – The Colquitt County Board of Education tentatively set its millage rate, which will increase property taxes ... Read more

ATLANTA — The Internal Revenue Service has announced tax relief for individuals and businesses in Georgia that were ... Read more

A new study shows that undocumented immigrants paid nearly $100 billion in federal, state and local tax revenue ... Read more

MOULTRIE — At a called meeting Tuesday, the Colquitt County Commission agreed to assist in funding, in part, ... Read more

PERRY – AgGeorgia Farm Credit is disbursing $7,828,920 to current and former borrowers of the cooperative. Members who ... Read more

PERRY – AgGeorgia Farm Credit is disbursing $7,828,920 to current and former borrowers of the cooperative. Members who ... Read more

ATLANTA – Limits on donations to a state tax credit that supports foster children aging out of the ... Read more

MOULTRIE — The Moultrie-Colquitt County Development Authority and a private developer are close to a deal that promises ... Read more

While many Americans will need long-term care as they get older, few are prepared to pay for it. Read more