Property tax rates decline for 2021

Published 6:39 pm Friday, September 24, 2021

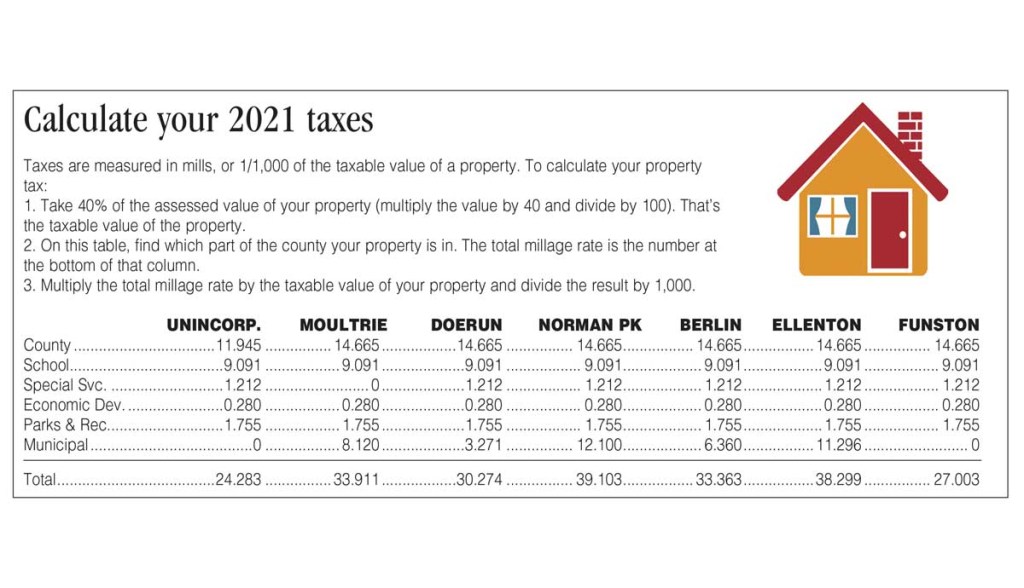

- Tax rates differ whether the property is in the unincorporated county or in one of the county's six municipalities.

MOULTRIE, Ga. — Unless your property value went up this year, your tax bill will be going down.

The Colquitt County Commission and City of Berlin gave final approval to their property tax rates Thursday night, the last of all of Colquitt County’s taxing entities to do so. All decreased their rates or held them the same except for Doerun, whose small increase in the municipal tax rate was more than offset by decreases in county taxes.

The tax rates are measured in mills. One mill equals 1/1,000 of the taxable value of a property. Taxable value is 40% of the property’s assessed value.

Millage rates for 2021 include:

• County, unincorporated: 11.945 mills, down from 12.142 last year. This tax is paid to the county by property owners outside of the municipalities.

• County, incorporated: 14.665 mills, down from 15.000 last year. This tax is paid to the county by property owners within Colquitt County’s six municipalities.

• Special service district: 1.212, down from 1.231. This tax is paid by property owners outside the city of Moultrie for certain county services that aren’t available within Moultrie, mainly the services of the volunteer fire departments.

• Economic Development: 0.280, down from 0.289. This tax goes to the Moultrie-Colquitt County Development Authority to support economic development efforts.

• Parks & Recreation: 1.755, down from 1.788. This tax goes to the Moultrie-Colquitt County Parks and Recreation Authority to fund recreation programs.

• Moultrie municipal tax: 8.120, down from 8.140.

• Doerun municipal tax: 3.271, up from 3.269.

• Norman Park municipal tax: 12.100, the same as last year.

• Berlin municipal tax: 6.360, down from 6.362.

• Ellenton municipal tax: 11.296, down from 11.350.

• The Town of Funston doesn’t have a municipal property tax.

All property taxes are collected through the Colquitt County Tax Commissioner’s Office. Tax Commissioner Cindy Harvin said she hoped to have bills in the mail by Oct. 10.