Q&A: State House budget czar calls Great Recession lesson for 2020 pain

Published 10:30 am Wednesday, July 8, 2020

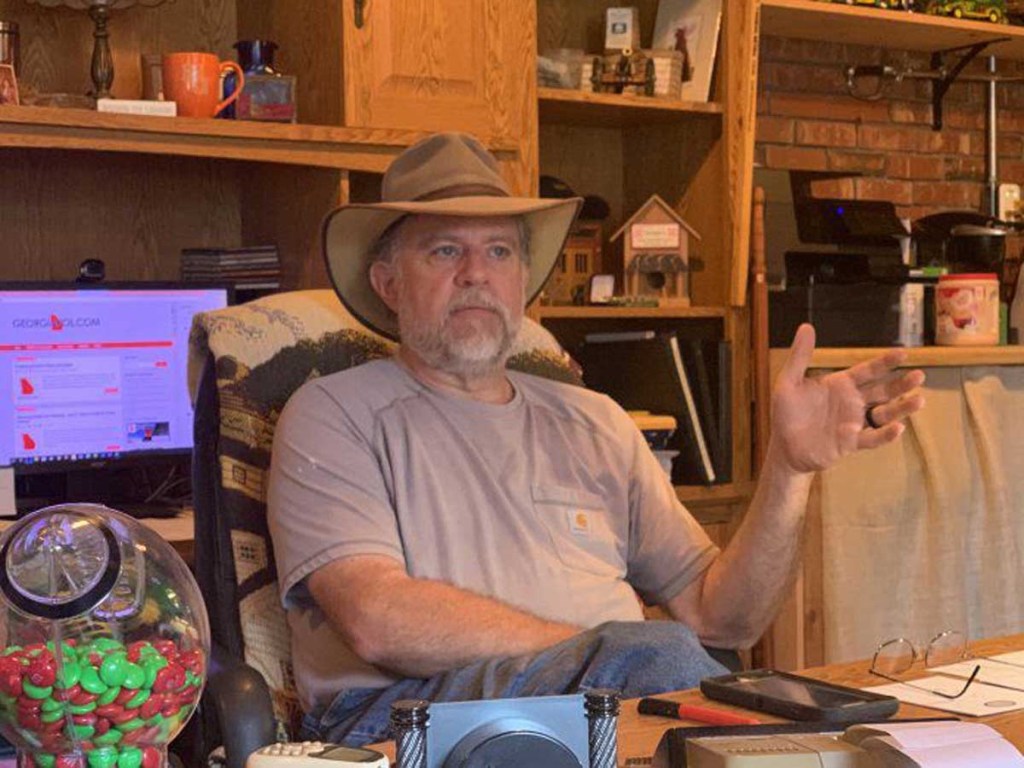

- Rep. Terry England, Chairman of the House Appropriations Committee, compares making painful cuts in this year's budget to the Great Recession when lawmakers annually slashed $1 billion in education spending. He sat down this week for a Q&A at his Auburn home office.

AUBURN, Ga. — Last August, the Georgia lawmaker with prime oversight over state spending kicked back in the office behind his Auburn home and recalled his trial by fire when he took on the job during the worst of the Great Recession.

Just before the Georgia Recorder visited Rep. Terry England last summer, Gov. Brian Kemp’s administration sent state department heads a sobering memo to cut the 2021 budget by 6%. The House Appropriations Chairman suggested back then that tight budgets in recent years meant a 6% across the board likely would cost state workers income at least.

Trending

Fast forward to early March when England announced a bargain in the House to include a promised teacher pay raise, a state income tax cut and still balance a $28.1 billion budget.

Some of his fellow GOP House colleagues back then dismissed the potential fallout from new coronavirus concerns as the House approved the state budget. Days later lawmakers suspended the 2020 General Assembly for what turned into three months. They returned June 15 to pass a budget slashed by $2.2 billion after shutdowns caused by the pandemic sapped state revenues. As happened several years in the austere era of the Great Recession, k-12 education suffered a $1 billion cut.

During a visit this week to his Auburn office, England recalled the strange 2020 legislative session upended by the COVID-19 pandemic. And he took a long view toward better days he’d like to see when lawmakers return to the Capitol next January.

Below are excerpts from a conversation with the 15-year lawmaker, edited for clarity and brevity.

———

How do you feel about the budget that you were able to present and get passed?

Trending

Actually I was surprised at what we were still able to accomplish. The 6% reduction was only a very small portion of the budget because anything related to education was exempt as far as direct classroom instruction and hiring. The university system, technical colleges and Medicaid was exempt.

But what we wound up having to do because of COVID was literally cutting 10% across-the-board on paper.

If we exempted all those things that were (proposed) initially, then the cuts to things like the Department of Behavioral Health and Developmental Disabilities, Corrections would have been about 30%.

Sure, it means that you’re hurting some things that you really battle over like in education. But when you look at the budget, you realize that 53% of the entire budget goes to k-12 education and the university system. And you’ve got to find over $2 billion in the next cut, so it makes it kind of hard not to look at that.

We were able to really focus on the services within the behavioral health services, public health and some of those things and lessen their cuts. Some agencies wound up with more than 10%.

Ultimately, we wound up not having any agency having to furlough employees.

———

Two of the bigger priorities going into the 2020 session were an income tax cut and a teacher pay raise. Which one of those will be a bigger priority when the economy improves?

When we hit the pause button thinking we were going to come back in two weeks everything was still on the table. Then those two weeks turned into three months.

At some point everyone came to the realization that the budget we had passed out of the House with the $1,000 teacher pay raise, 2% for all state employees and and the income tax cuts, are all off the table. We will come back and address them at some point.

I don’t know what the priorities will be. That’s above my pay grade. The Speaker feels like the tax cut is a promise that we made and I respect that. And I respect that the governor’s goal of a $5,000 total teacher pay raise is a promise he wants to keep.

I want to help them get what they promised but at the same time we have got to do it in a responsible way that doesn’t put us in a bad position.

———

What do you expect the process of amending the 2020 budget to be like in January, especially if the economy is better than expected?

We always look at enrollment growth in k-12 education and see what gets changed there. I will tell you that likely at the top of everyone’s list will be to get money back into education.

And then we will look at some other stuff. As painful as it is, it’s not a bad exercise to do every so often if you’re running your own business is to look through every expenditure and realize that there are some things such as I’m still paying $50 a month for a health club I haven’t been to in three months.

It’s natural to go through those exercises. The Great Recession forced us to do that and this COVID-19 has forced us to do that. I think we do a very good job of staying on top of it but over time everything changes and you have to go back and look at everything you’ve been doing.

———

While looking for new revenue streams, some pushed for an increase in the cigarette tax. Do you think that’ll get serious consideration no matter what the economic picture is next year?

I understand that (our cigarette tax) is one of the lowest in the country and one of the lowest in the Southeast. One day I heard a (revenue) number of $600 million

But the estimates that I’ve seen say $200 million is the top and then it becomes regressive fairly quickly and then number starts falling off depending on where you go on the tax level.

Part of that is that it’s meant for to get people to stop smoking because it’s too expensive. But at some point this discussion becomes should we outlaw smoking. I don’t know. That’ll be up for someone else to discuss at some point.

I guess the point is when you’re looking for $2 billion (in cuts), $200 million is a lot but it’s still a long way to go. I know my friends in the Democratic Party pushed hard for a higher cigarette tax.