Key revenue measures hit roadblocks in Oklahoma

Published 6:51 pm Tuesday, April 10, 2018

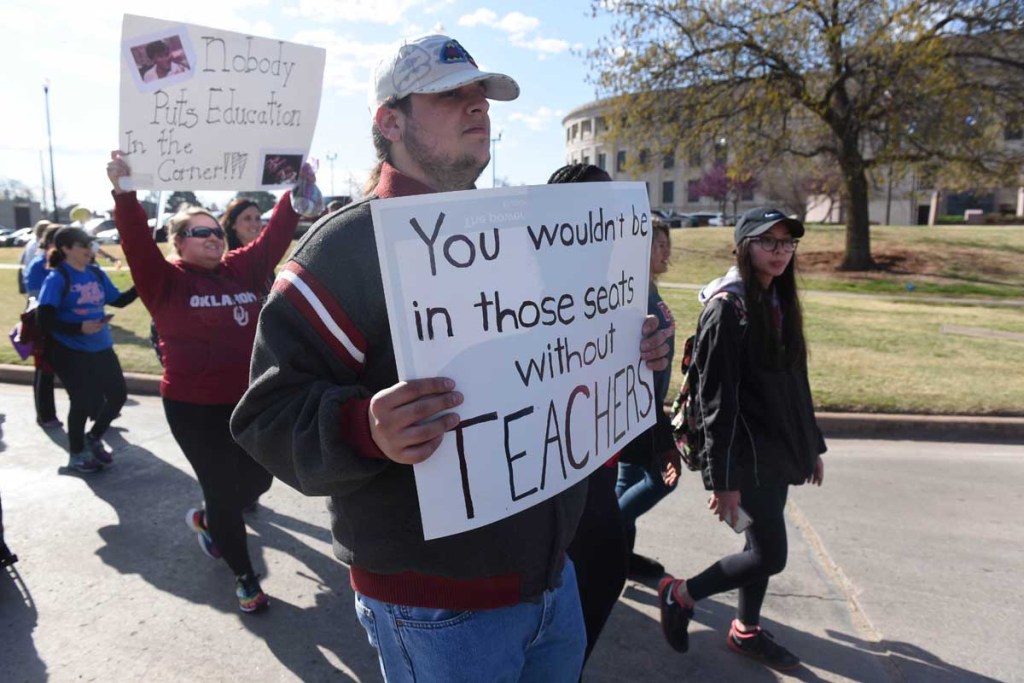

- Oklahoma teachers rally at the Capitol, Monday, April 9, 2018, during day six of the Oklahoma teacher walkout. (Kyle Phillips / The Transcript)

OKLAHOMA CITY — As teachers pinned their walkout hopes on the repeal of a controversial capital gains deduction, the measure’s author said Tuesday that it should not advance.

“I have no desire to run the bill or vote for the bill,” said state Rep. Earl Sears, R-Bartlesville.

Also on Tuesday, Oklahoma Gov. Mary Fallin approved the repeal of a $5 per night hotel/motel occupancy tax. Teachers were calling on her to veto the bill because it could have generated about $48 million for education and helped fund recent raises awarded to classroom teachers.

The state’s largest teacher’s union, the Oklahoma Education Association, said last week that the ongoing teacher walkout would end if lawmakers could repeal the capital gains deduction, and if Fallin would veto the hotel/motel tax.

As Day 7 of the statewide walkout progressed on Tuesday, Oklahoma educators continued to support the deduction and veto.

Districts across the state have closed to give teachers time to advocate for increased education funding at the state Capitol. Turnout, though, appeared noticeably smaller Tuesday than previous days.

More than 500,000 students who attend nearly 160 school districts across the state have been affected by the school closures, according to a recent analysis by the Tulsa World.

Alicia Priest, Oklahoma Education Association president, said Tuesday afternoon that educators aren’t married to one funding idea. She wants lawmakers to provide the equivalent funding to both the measures in order to end the walkout and ensure schools are funded adequately.

“There are many ways to get to the end destination,” Priest said. “We’ve said all along here’s a road map, but there are other routes to get to that same funding destination.”

Eliminating the capital gains deduction could net state coffers an average $120.5 million a year, according to the Oklahoma Tax Commission.

But Sears said he’s fearful that eliminating it would harm the state’s agricultural industry, which is one of the biggest industries that claims it.

Under current law, Oklahomans who sell property, stock or ownership interest in a company headquartered in the state can claim the tax deduction on any gains they collect, which supporters say benefits small business owners and entrepreneurs.

“(The measure) has created a lot of concern with members of the Republican Party and constituents across the state that would (lose) these capital gains that have been utilized,” Sears said.

The capital gains measure has passed the Senate, but remains stalled in the state House.

Critics of the deduction contend it is only benefiting a small number of Oklahomans each year.

David Blatt, executive director of the liberal-leaning Oklahoma Policy Institute think tank, said the deduction is “poorly targeted and poorly monitored.”

“The tax break was never intended or designed to support agriculture, and the five-year holding period for qualified property means that most cattle operators already do not qualify,” he said in a statement.

Blatt said two-thirds of the deduction is taken by about 800 wealthy households.

In a statement, the Oklahoma Association of Realtors said it opposes attempts by lawmakers to end the capital gains deduction.

“Long-term investment and stability for our communities are key to Oklahoma’s economic growth and prosperity,” said Jessica Hickok, chief executive officer, in a statement. “Removing those exemptions will drive individuals and businesses from our state and hurt Oklahoma’s economy.”

House Floor Majority Leader Jon Echols, R-Oklahoma City, said he met Tuesday morning with Gov. Mary Fallin and Senate leaders, and neither has any desire to proceed with the measure.

“I think it’s probably not the best option right now,” he said.

Echols said the tax deduction is volatile, and it’s hard to predict just how much people will claim.

The amount claimed in the past 10 years has fluctuated with the highest expenditure — $188.5 million — in tax year 2007 to the lowest — $47.5 million — in tax year 2009, according to the Oklahoma Tax Commission.

Stecklein covers the Oklahoma Statehouse for CNHI’s newspapers and websites. Reach her at jstecklein@cnhi.com.