Canadian firm buying Beadles Lumber Co.

Published 10:35 pm Saturday, August 2, 2014

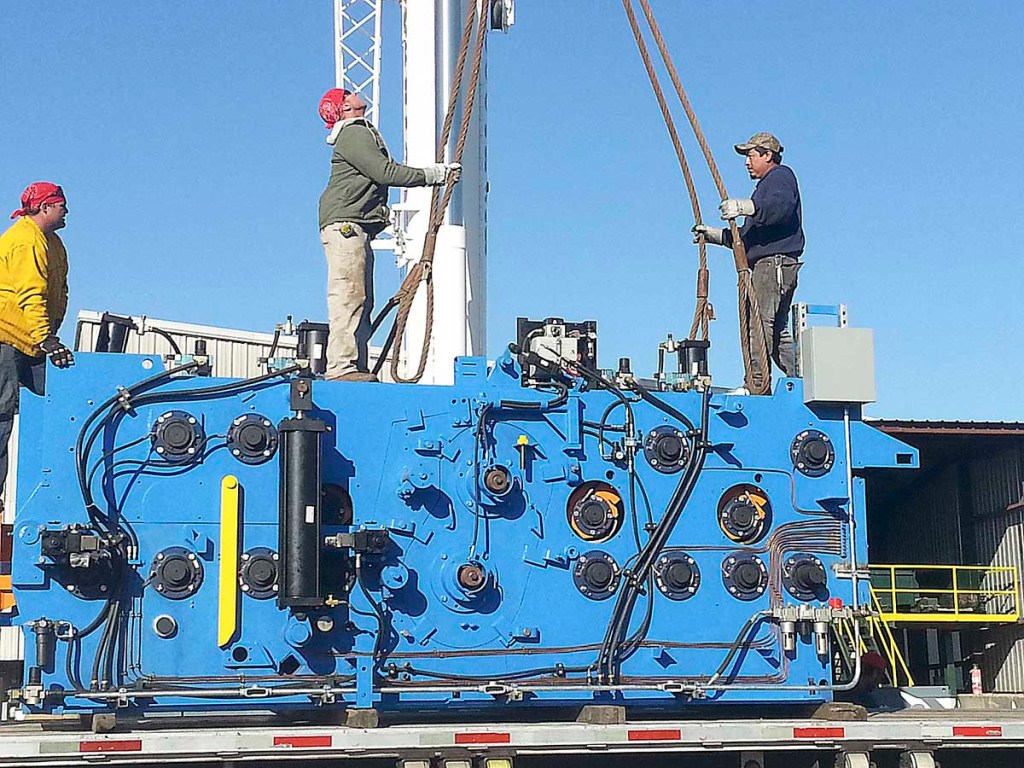

- Workers position new equipment at Beadles Lumber Co. as part of a $2.6 million modernization project. Less than two weeks after announcing completion of the upgrade, Victor Beadles, owner of both Beadles Lumber Co. in Moultrie and Balfour Lumber Co. in Thomasville, has announced the sale of both of the sawmills to Canfor, the largest lumber producer in Canada.

Beadles Lumber Company of Moultrie and Balfour Lumber Company of Thomasville announced Friday they have entered into a strategic partnership agreement with Canfor Corporation.

The transaction involves the phased purchase by Canfor Corporation of these mills over a two-year period.

Canfor’s interest will be 55 percent and increase to 100 percent in January of 2017. The British Columbia-based company recently added additional southern pine to its production portfolio in 2013 with the acquisition of Scotch Gulf Lumber’s three mills in Alabama. Canfor is presently the second largest lumber producer in the world and the largest in Canada.

“With the increased globalization of the lumber market, Beadles Lumber and Balfour Lumber see the value in joining with a large multinational forest products company with the resources and scope for investments and marketing,” Victor Beadles said in a press release. “However, maintaining the tradition of high quality that has exemplified these family-owned companies for many years is equally important. Canfor is committed to the longterm viability of the employees, customers, suppliers and vendors that depend on these two companies and will retain the current employees, management and systems that have made Beadles and Balfour what they are today.”

The Beadles family presently owns all the stock in Beadles Lumber and Balfour Lumber, and Victor Beadles and Bryant Beadles will continue to be involved with the operations and management at these mills with Bryant Beadles serving as president.

Beadles Lumber Company’s approximately 7,000 acres of timberland and its hunting lodge (Samara Plantation) are not included in this sale. Balfour Timber Company and Balfour Land Company are also not included in this sale.

Beadles Lumber Company and Balfour Lumber Company are represented by Lanigan & Associates P.C. as investment bankers. Legal counsel is being provided by Maynard, Cooper & Gale P.C.

The transaction is subject to standard closing conditions and is expected to close on Jan. 2, 2015.